Abortion is basic health care and therefore should be covered by health insurance. However, in passing the Affordable Care Act (ACA), Congress decided against guaranteeing coverage of this basic health service, and established rules unique to abortion coverage. Under the ACA, an issuer opting to cover abortion care in marketplace plans must follow particular administrative requirements to ensure that no federal funds go toward abortion. Moreover, states retain the option to ban abortion coverage in marketplace plans outright, and half of states have already done so. Given the special treatment of abortion care under the ACA and the confusion it has created, individuals covered by or shopping for a plan should be at least able to easily discern whether and to what extent a plan covers such care.

In the ACA’s first full year of implementation, however, individuals were largely unable to obtain clear, consistent information on whether a given plan covered or excluded abortion, according to a 2014 Guttmacher Institute analysis. Building on that analysis, Guttmacher has gathered sufficient information about 2015 marketplace plans to determine that this is an ongoing problem. Antiabortion policymakers and advocates are exploiting this lack of publicly available information on abortion coverage to call for new legislation that purportedly advances transparency, but is actually aimed at discouraging—if not eliminating—abortion coverage altogether. For its part, the Obama administration recently acknowledged that it can do more to ensure greater transparency about abortion coverage in the marketplaces and has proposed rules to that end—rules that, once finalized, should diffuse future calls for congressional action. Ultimately, a clear and consistent approach to providing information on abortion coverage will make it easier for plans to do so, and will help individuals to be better informed as they choose and use their health insurance.

Co-Opting Transparency

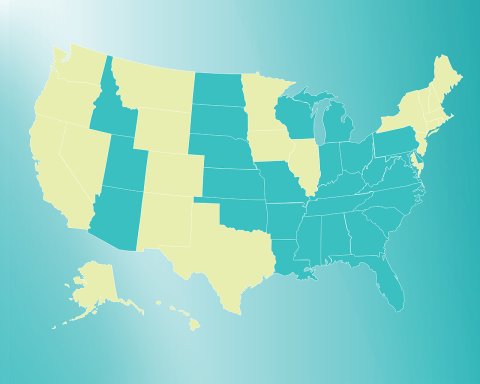

Under the ACA, insurance plans are neither required to nor prohibited from covering abortion. Twenty-five states, however, have enacted laws prohibiting coverage of abortion on their health insurance marketplaces (see map).1 In the remaining states, if a marketplace plan issuer opts to cover abortion care beyond the narrow circumstances of rape, incest and life endangerment (i.e., the limited conditions the federal government adheres to for its own employees and others eligible for federally subsidized health care or coverage), then the ACA requires the issuer to follow special accounting mechanisms. The issuer must establish two separate accounts into which enrollees’ premium payments are deposited: one from which abortion claims (beyond instances of rape, incest or life endangerment) are paid and another comprising the vast majority of enrollees’ premium dollars from which all other claims are paid. This arrangement is intended to ensure that federal subsidies are segregated from the private funds used to cover abortion. Antiabortion policymakers now commonly use the deceptive term "abortion surcharge" to describe the proportion of an individual’s premium payment separated for coverage of abortion.

Notably, the ACA allows, but does not require, issuers to itemize or separate on a monthly premium bill the part of the premium that goes toward abortion coverage. Plus, the law allows for enrollees to pay the full amount of their premium, including the proportion going toward abortion care, with a single payment. Although this situation raises suspicion in the minds of antiabortion members of Congress, a U.S. Government Accountability Office (GAO) review they requested on abortion coverage under the ACA found no evidence of noncompliance with these provisions.2

The ACA does state that plans covering abortion beyond cases of rape, incest or life endangerment must inform individuals of this coverage "as part of the summary of benefits and coverage explanation, at the time of enrollment." Summary of benefits and coverage (SBC) forms are standardized documents providing basic, comparable coverage and cost information that all private plans, including those offered through insurance marketplaces and by employers, must make available to consumers and enrollees under the ACA. The law requires plans to disclose any major coverage exclusions, although nothing in the law stipulates that any specific attention be paid to abortion.

Both sides of the abortion rights divide appear to agree that the lack of easily accessible information on whether and how plans cover abortion care is a problem. In practice, however, antiabortion policymakers clearly are pursuing a much more radical agenda under the pretense of advancing transparency.

On January 22, timed to coincide with the annual March for Life organized by opponents of the Supreme Court’s Roe v. Wade decision, Rep. Chris Smith (R-NJ) introduced and the U.S. House of Representatives passed the No Taxpayer Funding for Abortion and Abortion Insurance Full Disclosure Act of 2015; the bill is identical to a version the House passed in 2014, but which never became law. Despite highlighting "disclosure" as a main purpose, the bill would render transparency largely moot, as it aims to eliminate abortion from both private and public insurance coverage.

Most notably, Rep. Smith’s bill would effectively force abortion coverage out of states’ health insurance marketplaces by prohibiting a plan from covering abortion if even a single plan enrollee received any federal insurance subsidies; around 85% of marketplace enrollees receive these subsidies.3 This scheme would have essentially the same impact as what was known as the "Stupak Amendment," an antiabortion proposal that Congress rejected during the original debate on health reform in 2009 and 2010. The bill would also discourage coverage in the group market by barring small employers from receiving health insurance tax credits if their plans cover abortion. And it would permanently eliminate abortion coverage for low-income women enrolled in Medicaid and others dependent on the federal government for health insurance by codifying existing limitations throughout federal law that currently must be renewed each year through the appropriations process.

Despite the private market restrictions in this bill, Rep. Smith and his allies have hedged their bet, in case any plans with abortion coverage were to remain on the marketplaces. For those plans, issuers would be required to single abortion out from other services and "prominently display" information on abortion coverage in all marketing and advertising materials for all marketplace plans, and to provide information on what these lawmakers misleadingly refer to as "abortion surcharges." These measures go beyond mere transparency and are designed to stigmatize abortion coverage.

Continuing Confusion

The disingenuous campaign for disclosure from antiabortion activists notwithstanding, real issues with transparency persist. The GAO and the Guttmacher Institute have found continuing problems with individuals’ ability to readily and easily determine whether and to what extent plans cover abortion.

It was antiabortion members of Congress who asked the GAO to examine the extent to which 2014 marketplace plans covered abortion services beyond cases of rape, incest and life endangerment.2 According to the GAO’s report, issued in September 2014, the vast majority of issuers did not offer clear information—and some offered none—to individuals shopping for plans on the marketplace about whether abortion care is covered. These findings on transparency, or lack thereof, echo those of a Guttmacher Institute analysis published earlier in 2014 (see "Abortion Coverage Under the Affordable Care Act: The Laws Tell Only Half the Story," Winter 2014), and a more recent Guttmacher review of 2015 marketplace plans, presented here. Although more SBCs from 2015 than from the previous year address abortion, the vast majority say nothing. Among those that do address abortion coverage, the way the information is provided varies considerably and is not always informative.

Currently, 25 states ban abortion coverage on their marketplaces.1 In the remaining 26 states (the District of Columbia is counted as a state for the purposes of this analysis), abortion coverage is legally permitted in marketplace plans, and plan documents were publicly available online in 25 of them. In each of these 25 states, Guttmacher examined marketplace plans currently available to an individual living in the state’s most populous county—looking at SBCs and, when necessary and available, at additional documents offering more detailed lists of covered services and exclusions.

Of the 25 states Guttmacher studied in 2015, five have no SBCs that describe plans’ abortion coverage (see table). In another nine states, only a single issuer does so. This is an improvement from 2014, when abortion coverage or exclusions were not described in any of the SBCs examined on 15 of 23 states’ online marketplaces.

.png) On the basis of the SBCs and additional documents for 2015 available online, issuers in 12 states clearly offer plans that cover abortion beyond cases of rape, incest or life endangerment. In all 12 of these states and 10 others (a total of 22), at least one plan clearly excludes abortion coverage. Notably, issuers are much more likely to be explicit in their SBCs when they exclude abortion than when they cover it: In 20 of the 21 states where at least one plan does not cover abortion, Guttmacher found this information in the SBC, whereas in six of the 12 states where at least one plan covers abortion, that information was readily available in an SBC.

On the basis of the SBCs and additional documents for 2015 available online, issuers in 12 states clearly offer plans that cover abortion beyond cases of rape, incest or life endangerment. In all 12 of these states and 10 others (a total of 22), at least one plan clearly excludes abortion coverage. Notably, issuers are much more likely to be explicit in their SBCs when they exclude abortion than when they cover it: In 20 of the 21 states where at least one plan does not cover abortion, Guttmacher found this information in the SBC, whereas in six of the 12 states where at least one plan covers abortion, that information was readily available in an SBC.

Importantly, when issuers do mention coverage or exclusion of abortion services in SBCs, this information may appear in several different places on the form, which makes it difficult to find and compare across plans. And the language used to describe abortion coverage or exclusions varies significantly among issuers: For example, some describe that "elective abortion is not covered" or "coverage includes pregnancy termination services," and others denote coverage of "voluntary termination of pregnancy" or exclusion of "interruption of pregnancy."

Moreover, in trying to comply with the ACA and state law, some issuers use language that is highly bureaucratic, circular and confusing. For instance, one issuer states "Includes voluntary abortion services rendered by a licensed and certified professional provider, including those for which federal funding is prohibited." Another says "Coverage includes termination of pregnancy. Laws prohibit funding of certain covered terminations of pregnancy. Premium payments are segregated to ensure compliance." And yet another issuer’s SBCs only say "Pregnancy termination services are subject to restrictions and state law."

Getting to True Transparency

The Obama administration has recently acknowledged the lack of sufficient clarity in abortion coverage and is proposing new regulations to advance an "interest of increasing transparency for consumers shopping for coverage, and to assist issuers with meeting applicable disclosure requirements."4 These proposed rules—issued in December 2014 and still being finalized in response to public comment—would update SBCs for the 2016 plan year. Issuers of marketplace plans would be required "to disclose on the SBC whether abortion services are covered or excluded and whether coverage is limited to services for which federal funding is allowed." In proposed updates to the guide for issuers of individual health plans on how to complete the SBC, the administration instructs issuers to include information on abortion coverage at the end of the SBC form, in one of two boxes where certain services can be briefly listed as either covered or not.5 These all represent steps in the right direction, but additional steps would substantially benefit individuals’ decision making about which plan to buy or how to use the plan they have.

First, issuers should be required to post an electronic SBC for each plan offered through each insurance marketplace website; Guttmacher found multiple instances where SBCs were not available. For those seeking individual coverage outside the marketplaces or selecting an employer-based plan, issuers should post plan SBCs to their own websites, as well.

Second, requiring all plans that must provide an SBC to present information on abortion coverage and exclusions would streamline the process for issuers and enable individuals to compare plan options. This should include not only marketplace plans (as proposed in the December 2014 rules), but all individual plans and group plans offered by employers and other entities. This must also apply to SBCs in all states, including where abortion coverage is banned in the marketplace; it is unreasonable to expect all individuals living in states that ban abortion coverage to be aware of their state’s policy.

Going further, specifically guiding issuers to include information on abortion coverage or exclusions in the same place on each SBC and to use consistent language would make comparing plans easier for individuals and help ensure they understand the details of their coverage. Individuals need to be able to rely on issuers to detail whether abortion is covered, to provide information on cost-sharing for enrollees and to explain applicable limitations or exceptions. If a plan covers abortion only in certain circumstances, including when the woman’s life is endangered or the pregnancy is the result of rape or incest, the SBC should clearly denote these circumstances. Issuers should also be specifically instructed on how to describe coverage limitations or exceptions while avoiding legal jargon and biased terminology. For instance, in describing an exception for life endangerment, "life of the woman" is more accurate and politically neutral than "life of the mother" (the phrasing proposed in December 2014 draft instructions to issuers of individual plans for completing the SBC).5 Moreover, "elective abortion" is unhelpful because it has no medical meaning and is subject to multiple interpretations.

Finally, all SBCs should include a link to more detailed plan documents where consumers can find more thorough explanations of the coverage or exclusion of abortion, among other health services. The ultimate goal of all of these actions would be to ensure that all individuals—whether they are looking for a plan that includes or excludes abortion care—have easy access to clear, unbiased information on whether and to what extent a plan covers abortion.

Getting to Coverage

Beyond this goal of transparency, women nationwide should actually have at least one coverage option that includes abortion services. Far too many women today are left without such a choice. Half the states ban abortion coverage within their state insurance marketplaces. Moreover, in 2014, the GAO found that eight states without restrictions on abortion coverage still had no marketplace plans that covered abortion beyond cases of rape, incest and life endangerment.2 Guttmacher’s 2015 analysis indicates that in only one of these eight states (New Hampshire) is there now at least one plan that clearly covers abortion, which seems to leave women in seven states without coverage options they could and should have. A recent Kaiser Family Foundation analysis with a different methodology came to the same conclusion.6 This suggests that there are only 18 states and the District of Columbia where even a single plan offering abortion coverage could be available on the marketplaces.

One avenue for addressing this situation is the ACA’s multi-state plan program, administered by the Office of Personnel Management (OPM). Under this program, the agency contracts with issuers to offer plans on marketplaces across multiple states as a way to advance competition and choice. OPM is required to ensure the availability of these plans in every state by 2017. The program continues to be phased in, and now offers more than 200 plans across 36 states, up from about 150 plans across 31 states in 2014.7

The ACA mandates that at least one of the multi-state plans on each state’s marketplace excludes abortion coverage, with permissible exceptions for cases of life endangerment, rape and incest. Antiabortion activists have not held back in agitating for this position. Last year, an activist in Connecticut filed a lawsuit against the federal government and the state marketplace complaining that all marketplace plans covered abortion; Connecticut was a state where OPM had not yet installed any multi-state plans. Although there was no violation of the ACA because of the phased nature of the multi-state plan program, for 2015, OPM placed two multi-state plans that exclude abortion on the Connecticut marketplace and the lawsuit was dropped.8 Similar suits were also filed in Rhode Island and Vermont—two of four states where OPM has yet to offer multi-state plans and where all other coverage options seemed to cover abortion. The Rhode Island marketplace added a plan that excludes abortion early in 2015.9

By contrast, there is almost no recognition that individuals seeking plans that cover abortion deserve similar assurances. In OPM’s December 2014 proposed rules on the multi-state plan program, the agency detailed only how it will ensure a choice of plans that exclude abortion.10 OPM can, and should, exercise its authority to achieve balance and equity, especially given that the law itself is one-sided. If OPM were to also require that at least one multi-state plan cover abortion, women in states where such coverage is permitted would at least have the option of abortion coverage; in other states, the ban on abortion coverage would first need to be repealed.

Ensuring at least the option of a plan that covers abortion care would be one small step forward. However, few individuals buying insurance entirely base their decision on whether the plan covers an individual service—particularly a service like abortion, which no woman plans to need. What women really need is the option to use their health coverage for abortion if and when they find themselves in need of such care. California is leading the way toward this principle of true equity in access by requiring that all plans cover abortion. Last year, the state’s Department of Managed Health Care clarified that a 1975 state law "requires the provision of basic health care services and the California Constitution prohibits health plans from discriminating against women who choose to terminate a pregnancy. Thus, all health plans must treat maternity services and legal abortion neutrally"—meaning that if a plan covers maternity care, it must also cover abortion.11

Indeed, abortion ideally would be covered by health insurance throughout the United States as a matter of course. In the absence of that guarantee, individuals at least should have the option of buying an affordable health plan that includes abortion coverage. Everyone should have access to clear and useful information regarding abortion coverage so they can make an informed judgment before purchasing a plan. And finally, women in need of an abortion need easy access to factual information about whether and to what extent their plan covers abortion care. The Obama administration, state policymakers and issuers all have a role to play toward achieving these ends that would serve their interests while benefitting women.

This article was made possible by a grant from the Educational Foundation of America. The conclusions and opinions expressed in this article, however, are those of the author and the Guttmacher Institute. The author thanks Adara Beamesderfer and Elana Margosis for their research assistance.

REFERENCES

1. Guttmacher Institute, Restricting insurance coverage of abortion, State Policies in Brief (as of April 1, 2015), 2015, <http://www.guttmacher.org/statecenter/spibs/spib_RICA.pdf>, accessed Apr. 1, 2015.

2. U.S. Government Accountability Office, Health insurance exchanges: coverage of non-excepted abortion services by qualified health plans, Sept. 15, 2014, <http://www.gao.gov/assets/670/665800.pdf>, accessed Mar. 20, 2015.

3. Kaiser Family Foundation, Marketplace enrollees by financial assistance status, 2015, <http://kff.org/other/state-indicator/marketplace-enrollees-by-financial-assistance-status-2015/>, accessed Mar. 20, 2015.

4. Department of the Treasury, Department of Labor, and Department of Health and Human Services, Summary of benefits and coverage and uniform glossary, proposed rule, Federal Register, 2014, 79(249): 78578–78611, <http://www.gpo.gov/fdsys/pkg/FR-2014-12-30/pdf/2014-30243.pdf>, accessed Mar. 30, 2015.

5. Centers for Medicare and Medicaid Services, What this plan covers and what it costs: instruction guide for individual health insurance coverage, 2014, <http://www.cms.gov/CCIIO/Resources/Regulations-and-Guidance/Downloads/Instructions-Individual-12-19-14-FINAL.pdf>, accessed Mar. 30, 2015.

6. Salganicoff A and Sobel L, Abortion coverage in Marketplace plans, 2015, Issue Brief, 2015, <http://files.kff.org/attachment/issue-brief-abortion-coverage-in-marketplace-plans-2015>, accessed Mar. 20, 2015.

7. Archuleta K, Sneak preview of the Multi-State Plan Program in 2015, 2014, <http://www.opm.gov/blogs/Director/2014/11/14/Sneak-Preview-of-the-Multi-State-Plan-Program-in-2015/>, accessed Mar. 20, 2015.

8. Radelat A, Access Health CT adds some plans excluding abortion coverage, Connecticut Mirror, Dec. 1, 2014, <http://ctmirror.org/2014/12/01/access-health-ct-adds-some-health-plans-without-abortion-coverage/>, accessed Mar. 20, 2015.

9. Salit R, HealthSource RI now offers plan for abortion opponents, Providence Journal, Mar. 11, 2015, <http://www.providencejournal.com/article/20150311/NEWS/150319864/13975/?Start=1>, accessed Apr. 10, 2015.

10. Office of Personnel Management, Patient Protection and Affordable Care Act; establishment of the Multi-State Plan Program for the Affordable Insurance Exchanges, Federal Register, 2014, 79(226):69802–69819, <http://www.gpo.gov/fdsys/pkg/FR-2014-11-24/pdf/2014-27793.pdf>, accessed Mar. 30, 2015.

11. Department of Managed Health Care, Letter to Mark Morgan, California President of Anthem Blue Cross, Aug. 22, 2014, <https://www.dmhc.ca.gov/Portals/0/082214letters/abc082214.pdf>, accessed Mar. 20, 2015.

.png)